HMRC’s own figures suggest large increase in capital gains tax would backfire.

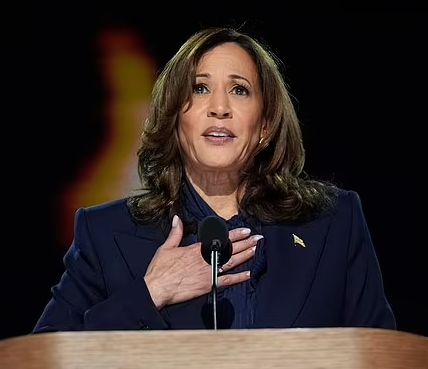

Chancellor Rachel Reeves (Image: Getty)

Rachel Reeves has been warned that a huge hike in capital gains tax would cost the Treasury billions of pounds.

The Chancellor is considering increasing the levy on the profit when an asset is sold at the Budget on October 30.

HMRC estimates that a one percentage point increase in the higher rate of CGT would raise just £100million.

But a 10 percentage point increase or more is expected to cut revenue by around £2 billion because so many investors would flee Britain.

It comes amid reports Ms Reeves is thinking about raising CGT as high as 39% in the Budget, which the Treasury last night denied.

Treasury modelling shows officials are testing a range of 33% to 39%, according to the Guardian.

A Whitehall source said Labour tax-raising plans were in “complete disarray”, while another added that “some very big tax decisions are being left until very late in the day”.

But a Treasury spokesman said: “This reporting is not based on government modelling – we do not recognise it. This is pure speculation.”

Officials have already warned Ms Reeves that her plan to target non-doms may not raise any money and could even cost the Treasury if it drives the super-rich out of Britain.

Shadow chancellor Jeremy Hunt told the Daily Mail: “It has only been 100 days, but already Labour’s Budget plans are in total disarray.

“Before the election they were repeatedly warned that their tax rises could cost money or damage growth, yet they refused to ditch them.

“Unfortunately as we are already seeing, it’s business confidence and future economic growth that will be a casualty of this chaos.”