The Chancellor is thought to be reluctant to turn the screw on businesses already reeling after the hike in their national insurance contributions.

Budget 2024: Rachel Reeves outlines approach to pensions

Rachel Reeves has reportedly put her pensions review on ice over fears it risks forcing employers to significantly raise their contributions to staff retirement schemes, potentially by billions of pounds.

The Chancellor is understood to want to avoid piling further pressure on businesses following the backlash to her Budget, which landed employers with a £25bn bill for additional national insurance contributions.

Pensions minister Emma Reynolds had promised to launch a review of retirement savings adequacy before the year’s end – but this has now been shelved indefinitely.

In accordance with current auto-enrolment rules, staff must contribute a minimum of eight percent of qualifying earnings to their workplace pension each year, with employers covering at least three percent.

However, experts warn that such levels are unlikely to provide many savers with adequate income in retirement.

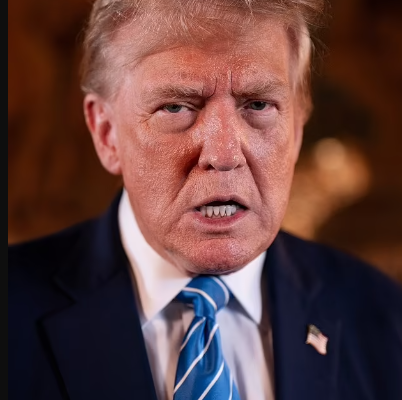

Rachel Reeves has reportedly put her pensions review on ice (Image: Getty)

Earlier this year, the UK’s largest retirement savings provider, Phoenix Group, estimated that raising the auto-enrolment minimum to 12 per cent could generate an additional £10bn in annual pension contributions, split between employees and employers.

The Financial Times reports that the Department for Work and Pensions (DWP

A source familiar with Treasury and DWP discussions said: “Rachel is very aware of the fact that businesses are facing increased taxes, and she is serious about ensuring no additional burdens are placed on them.”

In the first stage of the pensions review, Reeves outlined plans for “megafunds” of at least £25bn each, consolidating defined contribution and local government pension schemes. Such funds are aimed at releasing £80bn for investments in start-ups and infrastructure.

Former pensions minister Sir Steve Webb (Image: PA)

Although officials insist the second phase of the review is not being abandoned, no new timeline has been set, with one government official describing it as “TBC”.

A DWP spokesperson said: “We are determined to support tomorrow’s pensioners, which is why the government announced the landmark two-stage pensions review shortly after taking office. Further details on the second phase will be announced in due course.”

Former pensions minister Sir Steve Webb, who is now a consultant at LCP, called the delay “deeply depressing,” warning that it risks wasting valuable time.

He said: “The Budget was the death knell for the prospect of any serious progress on pensions adequacy.”

Rachel Reeves delivered her Budget in October (Image: Getty)

When the government confirmed its pensions review in July, it stated it would explore ways to improve pension outcomes and boost investment in UK markets, including assessing whether savers are adequately prepared for retirement.

Pension experts have voiced concern that further delays could jeopardise the retirement security of millions.

Research from the Institute for Fiscal Studies say between 30 to 40 per cent of savers in defined contribution schemes are likely to fall below the Pensions and Lifetime Savings Association’s minimum retirement living standards.

Zoe Alexander, director of policy at the PLSA, said: “This delay is deeply concerning. From our perspective, it’s a crucial piece of the pensions puzzle, and there’s no time to lose in having this debate.”

The PLSA has lobbied for minimum auto-enrolment contributions to gradually rise to 12 per cent of earnings.

Phoenix has projected that a 15-year delay in increasing contributions could see an 18-year-old lose approximately £35,000 in retirement savings.