Double humiliation for Rachel Reeves amid warnings that economic uncertainty is growing in the UK

Rachel Reeves’s spending and borrowing plans mean interest rates will fall by less than expected (Image: Kirsty O’Connor/HM Treasury)

Mortgage holders are facing years of extra financial burden because of Labour’s nightmare Budget, a new report has warned.

Interest rates will fall by less than expected during the next two years because of Rachel Reeves’s spending and borrowing plans, said the Organisation for Economic Co-operation and Development (OECD).

This means millions will have to fork out higher mortgage repayment costs for longer.

In further humiliation for the Chancellor, Bank of England boss Andrew Bailey said the Government’s “biggest issue” after the Budget is the way businesses react to the hike in National Insurance.

He also warned that economic uncertainty is rising in the UK as well as globally.

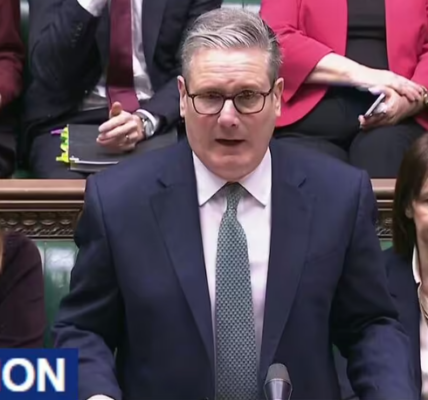

The double blow came as Sir Keir Starmer dodged repeating his vow for the UK to have the fastest growth in the G7.

The UK is in the bottom half of the table for the OECD’s 2025 economic growth forecast (Image: OECD)

The Prime Minister was challenged over the pledge by Kemi Badenoch as they faced off in the House of Commons.

Sir Keir, who will “reset” his floundering premiership in a speech on Thursday, is facing claims it is being sidelined, with seemingly little prospect of reaching the goal as the US is surging ahead.

The toxic fallout from Labour’s October Budget has made it even less likely.

Ms Reeves set out plans for almost £70billion a year of extra public spending, funded through tax rises and increased borrowing.

In its annual economic survey, the OECD said interest rates – which currently sit at 4.75% – are expected to fall back to 3.5% by early 2026.

The report said: “Fiscal policy will be tightening over 2024-26, though by less than expected, with significant fiscal loosening in the tax, spending, and borrowing package announced at the autumn Budget.”

Richard Fuller, Shadow Chief Secretary to the Treasury, said the report shows that the Chancellor’s “sums don’t add up”.

He said: “Labour told the public, printed in black and white in their manifesto, that they would not raise taxes on working people, and then their Budget did exactly that.

“Last week Rachel Reeves told businesses that there would be no more taxes and no more borrowing, and now even she won’t repeat that promise.

“The Chancellor has ducked difficult decisions on productivity and welfare reform, instead launching a tax and borrowing spree that pushes up inflation and risks interest rates staying higher for longer.

Andrew Bailey said the Government’s ‘biggest issue’ after the Budget is the way businesses react to the hike in National Insurance (Image: Getty)

“Now, she is seeing the consequences first-hand as the OECD today warns that Labour’s choices mean higher inflation and higher interest rates.

“Labour’s economic team is rapidly losing the confidence of business leaders and British workers who are savvy enough to know that the Chancellor’s sums won’t add up and she may soon be back for more.”

The OECD said UK inflation will also surpass previous forecasts next year, rising to 2.7% having previously said it will hit 2.4%.

The economic body predicted UK gross domestic product (GDP) will rise by 0.9% this year, a downgrade from its previous 1.1% forecast. It came after recent data from the Office for National Statistics showed the economy only grew by 0.1% in the third quarter of the year.

“But momentum is positive nevertheless, with retail sales on an upward trend since early 2024,” the report added.

Previously, the OECD had forecast 1.2% GDP growth for next year.

Economist Julian Jessop said: “The OECD is not alone in expecting interest rates to be slower to fall as a result of the additional borrowing in the Budget.

“Indeed the Government’s own fiscal watchdog, the Office for Budget Responsibility, raised its projections for interest rates and the markets have already factored this in.

“If anything, the risk now might be that rates fall more quickly than expected – but only because the tax increases in the Budget are hammering confidence and growth.”

Ms Reeves said: “Growth is our number one priority, and the OECD upgrade will mean the UK is the fastest growing European economy in the G7 over the next three years.

“That is only the start. Growth only matters if it’s matched by more money in people’s pockets.

“This Government will get our economy growing, with our National Wealth Fund, reforming the remits of our regulators and pension mega funds to attract better investment, as well as reforming our planning laws – all so that we can rebuild Britain for good.”

Speaking at the Financial Times’ Global Boardroom, Mr Bailey said it is not yet clear what effect the National Insurance tax change could have on UK inflation.

“The level of uncertainty is rising at the moment. Certainly, some of that is domestic and some of that is global,” he said.

“I think the biggest issue now in the immediate future is the response to the National Insurance change – how companies balance the mixture of prices, wages, the level of employment, what is taken on margin, is an important judgement for us.”

Most Popular Comments