Cost of super-rich leaving UK may exceed money raked in by new system, say Treasury sources

Officials believe that Sir Keir Starmer’s crackdown on non-doms could reduce tax revenues rather than raise them, it has been reported.

According to The Guardian, treasury sources are worried that new estimates could suggest the money raised may be exceeded by the costs of super-rich individuals leaving Britain.

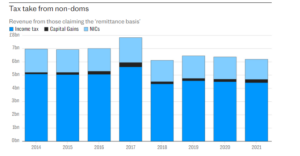

Currently, non-doms can avoid paying tax on overseas income and gains for up to 15 years.

But from April 2025, this system will be scrapped and replaced by a less generous residence-based regime that only allows wealthy foreigners to claim the tax break for four years.

The Office for Budget Responsibility (OBR) originally forecast that scrapping the tax status could raise about £3.2 billion a year.

At the time, the watchdog admitted that this estimate was highly uncertain because it was difficult to predict how non-doms would react to the proposals.

But senior government sources have told The Guardian they fear that new estimates set to be released by the OBR will reveal that the policy is predicted to raise no extra tax.

A Treasury source told the newspaper that ministers would listen to what the OBR said on tax and would prioritise the raising of greater revenues.

It was reported that the Chancellor is understood to be minded to press ahead with the tax changes at next month’s Budget and has publicly made a moral case in favour of the wealthy making a greater contribution.

If correct, the new forecasts would leave a £1 billion hole in the Government’s spending plans for schools and hospitals.

Labour had previously said it would spend £1 billion raised through the policy on universal school breakfast clubs and more hospital and dental appointments.

But its plans could be scuppered if the super-rich instead limit the amount of time they spend in Britain.

Earlier this month, Oxford Economics forecast that Britain’s non-dom population could fall by 32 per cent because of Labour’s reforms and that tax revenue could subsequently drop by £0.9 billion in 2029-30 because fewer wealthy foreigners will be living in the country.

The end of non-dom status was first announced by the Conservatives in March at the Spring Budget.

The party claimed that the move, set to be rolled out in April next year, would raise £2.7 billion.

Labour has proceeded with those plans and claims that closing loopholes in the Tories’ non-dom abolition plans would raise a further £2.6 billion over the course of this Parliament.

Around 55,000 non-doms claim tax relief in Britain, according to HMRC.

Non-doms only have to pay tax to the Treasury on the money they earn in Britain, meaning they are not taxed on earnings made overseas.