Labour wants to raise £3billlion, but risks angering non-doms who contributed nearly £9billion in taxes in 2022-2023.

Reeves has been warned that many non-doms could flee the UK (Image: Getty)

The Labour Party Government has been warned that a crackdown on non-doms could cost the UK economy nearly £1billion.

Prime Minister Sir Keir Starmer and Chancellor Rachel Reeves plan to raise billions from non-doms, who currently avoid paying tax on overseas income.

In April 2025, the Government is bringing in a new system with less generous rules that will only allow wealthy foreigners to claim the tax break for four years, rather than 15.

The Office for Budget Responsibility predicts that this could help raise £3billion but Oxford Economics research claims that this will actually cost the UK £1billion.

This is because many wealthy foreigners will instead opt to leave the UK, the researchers say.

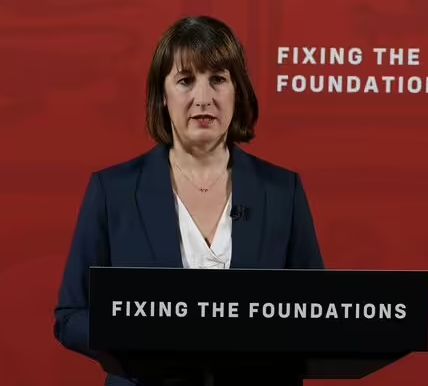

Labour aims to raise £3billion for the Treasury (Image: Getty)

Oxford Economics said the predicted hit of £0.9billion was based on surveys of 73 non-doms and 42 tax advisers who represent 952 non-dom clients.

The survey found that 63 percent of non-doms would leave the country if Sir Keir’s clampdown came into effect.

Those surveyed had a total £8.4billion invested in the UK economy. Non-doms paid £8.9bn in taxes in 2022-23.

Nimesh Shah, of accountancy firm Blick Rothenberg, told The Telegraph: “Given the recent dark picture painted by the Prime Minister and Chancellor, it has set even more hares running that taxes are about to exponentially increase, which is also leading UK entrepreneurs to consider their future in the UK.”

Chris Etherington, of accountancy firm RSM, said: “Rather than fixing the foundations, the Chancellor could find her financial forecasts are built on sand if we see large numbers of non-doms leaving the UK.

“The proposals to change the rules for non-doms have arguably been driven more by politics than economics, as there has only been limited research undertaken on the impact in the past.

“The Government is naturally keen to deliver on its manifesto commitments but they have rushed forward with no real understanding of how non-doms will respond.”

An HM Treasury spokesman said: “We are committed to addressing unfairness in the tax system.

“That’s why we are removing the outdated non-dom tax regime and replacing it with a new, internationally competitive, residence-based regime focused on attracting the best talent and investment to the UK.”