Chancellor is planning tax increases in her Budget, but former Labour minister Liam Byrne says she should cut them instead

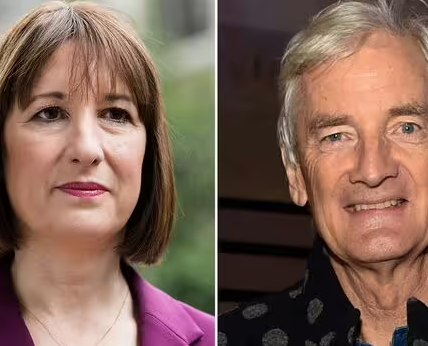

Former Treasury Minister Liam Byrne (Image: Jane Haynes/BirminghamLive)

Death and taxes, so they say, are the two great inevitables in life. But that’s only half true for Britain’s super-rich who have invented a million and one ways to keep their taxes low.

That’s why Chancellor Rachel Reeves needs to use her Budget to restore fair play to the tax system and put up taxes on the super-wealthy so we can cut inheritance tax for ordinary working people.

We like to think we’re a nation that plays by the rules. A nation that believes in ‘fair’s fair’. That is why the tax-dodging behaviour of the super-rich should make you angry.

If you’re like most people in this country, the last few years have been pretty tough. Your experience will be very different to the richest 1% of Brits, who have multiplied their fortunes by an average of £2.2million since 2010. That’s forty-one times more than everyone else.

Now no doubt some of that is down to sheer hard work, grit, spit and elbow grease. But is it now fair that so many of the very luckiest now pay lower rates of tax than everyone else?

Don’t miss…

Infected blood scandal compensation payments to begin this year [LATEST]

Nigel Farage’s Reform UK claims it now has more members than the Conservatives [LATEST]

Experts fear Ukraine’s NATO acceptance will spark apocalyptic WW3 with Russia [LATEST]

Robert Jenrick issues blistering takedown of Labour’s ‘biggest betrayal’ [LATEST]

Take Rishi Sunak. A wealthy man. Earns about £2million a year. Yet only pays 23% in tax. At a time when one in five people are paying over 40% tax, I just don’t think that is right. But Rishi Sunak is not the only one. Indeed new research shows that the average tax rate paid by those taking home £3million a year pay is less than 30%.

It’s time to sort this out. We need more tax inspectors, a crackdown on tax havens and one thing more. A tax rise on the very richest to fund a tax cut for everyone else, starting with inheritance tax.

Most Express readers will have worked hard all their lives, paid into the system and done their damnedest to save up and have something to pass onto the kids and grandkids.

Most of us know this is important because the younger generation have to face big debts for going to university and then face the Herculean task of saving for a deposit to buy a house that’s a hell of a lot more expensive than the 1970’s and 1980’s.

Don’t miss…

Warning Britain will run out of water in 15 years as £88bn rescue plan unveiled [LATEST]

Labour civil war as MPs make plea to Rachel Reeves over winter fuel raid [LATEST]

Cleverly lost Tory leadership race for being ‘too clever’, insider explains [LATEST]

Gloomy Rachel Reeves ‘threatening jobs’ as she’s ordered to stop talking UK down [LATEST]

Today no one pays inheritance tax if they’re passing on assets worth less than £325,000. There’s an extra £175,000 allowance for primary homes passed to direct descendants, and couples can combine their tax-free allowances. But after that the inheritance tax rate soars to a flat rate of 40%. Unless of course, you’re super-rich. Indeed, the latest figures show those worth between £2million and £7.5million paid just 25% in tax while those over £10 million only paid 17%. How can that be fair?

It isn’t. So, its time to adopt a new idea from the think-tank Demos and plug all the loopholes in the system and cut inheritance taxes for estates with under £1million from 40% to 30% and increase taxes for estates over £2 million from 40% to 45%. This would reduce taxes on working people by £410million but overall improve the tax take.

At the end of the day, we all know the country is in a tough spot. But if we want to restore fairness to the tax system, it is time the luckiest paid their dues. Get that right, and there’s a tax cut we can afford for those who spent a lifetime doing the right thing.

Liam Byrne is Chairman of the House of Commons Business Committee