How to stop Labour from taking your pension tax-free lump sum! B

Reeves faces pressure to meddle with the decades-old allowance in her upcoming Budget

Pension savers are on alert after Labour warned that “tough decisions” will have to be made in next month’s Budget.

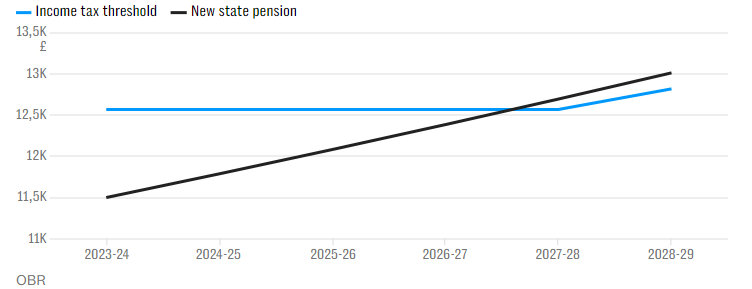

Chancellor Rachel Reeves has already stripped the winter fuel allowance from millions of retirees, and frozen tax thresholds will drag more pensioners into paying “retirement tax”.

However, the Institute for Fiscal Studies (IFS) has also urged Ms Reeves to further limit the amount that can be taken from pension pots tax-free.

Currently, savers can access 25pc of their retirement pots tax-free when they reach 55 up to a value of £286,275.

The suggestion by the think tank would see this allowance capped at £100,000, raising around £2bn a year for the Treasury.

It also recommends reforming how the relief operates so that those with larger pots and higher incomes do not benefit disproportionately.

However, any meddling with the decades-old allowance would be unpopular. By the IFS’ own admission, it would involve “some degree of retrospection”, meaning that people could reasonably argue that they had saved on the understanding they would be able to take 25pc of their pension tax-free.

So what can you do to protect yourself from this potential raid by Labour?

If you are approaching retirement age, or have already passed it, one way to avoid any changes is to make use of the allowance while you can. This is particularly true if you were planning to take the money out in the near-term anyway.

Sir Steve Webb, a former pensions minister, said that when changes have been made in the past, allowances are given for those who already exceed the new limits to ensure they don’t miss out.

He said that it is unlikely any change would take effect immediately after an announcement. If reform is announced, anyone who thinks they will be impacted should speak to an adviser as soon as possible before taking any action.

He said: “If a similar approach were to apply in this case, then this would reduce the need for people to make rushed decisions before the Budget.”

Rachel Vahey, head of public policy at investment firm AJ Bell, said that if those close to retirement or above the threshold are allowed to benefit from the current arrangement, it would be hard for the government to justify the change to younger workers.

She said: “The optics of a pension tax apartheid, which hands younger people a worse deal than that enjoyed by those already retired, would be a difficult one for any government to pitch to the public.”

Helen Morrissey, head of retirement analysis at investment service Hargreaves Lansdown, said that for retirees who have planned how to use their lump sum – for paying off their mortgage for example – any change will throw their financial planning into chaos.

At the same time, however, experts warn that taking money out of your pension in order to make use of the relief before you know what you are going to spend it on, could be a mistake and something you later regret.

For example, if you take the money out only to deposit it in a bank account paying out low interest rates, you risk losing out on the additional growth from keeping it in your pension pot. Its value could be whittled away over time by inflation.

Other options come with the risk of incurring taxes of a different kind. Increases to capital gains are one of the measures many are now looking out for in the Budget, and as such will hit investments outside of a tax-wrapper.

Capital gains tax is expected to raise around £15bn this year, rising to £23.5bn in five years’ time, according to forecasts from the Office for Budget Responsibility.

Beyond this, however, any advice on how to retain your tax-free lump sum will depend on the detail of what’s changed.

Ms Vahey said: “It’s quite a risky game trying to second guess policy like that – you’re giving up the benefits of a pension tax wrapper to try and protect against something that may or may not happen, so you could end up leaving yourself in a worse position.”

The question to be asking, said William Stevens, head of planning at firm Killik & Co, is what you want to use your pension fund for.

If it is to live off in retirement, then you need to maximise long-term efficiency rather than looking for a short-term fix. So it may not be sensible to rush in to taking money out of your pot.

However, if your aims are linked to inheritance planning, then the tax-free cash becomes more relevant.

Mr Stevens said: “If you are intending to leave that for future generations, then maybe it is worth taking it and gifting it sooner rather than later.”

Parents are rushing to give away wealth to their children over fears of a coming inheritance tax raid. Gifting assets allows a person to lower their inheritance tax liability by bringing the value of their estate underneath the tax-free allowance or as close to it as possible.

However, Mr Stevens urged caution to those looking to act to retain their full tax-free allowance adding that if changes do come in, savers should consult an adviser before taking any action.