Rachel Reeves urged to hit those relocating overseas with a capital gains tax charge

Rachel Reeves has been urged to impose an “exit tax” on wealthy investors moving their money out of the country.

Resolution Foundation, a Left-leaning think tank, has called for Labour to hit those relocating overseas with a capital gains tax charge.

It comes as wealth managers report a surge in the number of super-rich individuals leaving the country ahead of the Budget next month.

Under current rules, investors pay no capital gains tax on UK shares if they leave Britain for more than five years.

However, in a report exploring the fiscal choices facing the Chancellor in the Budget on October 30, the Resolution Foundation, which has close links to Labour, recommended scrapping this rule.

The think tank said: “An Australian-style exit charge should be introduced that levies capital gains tax when people move out of the country.”

Countries such as Australia, Canada and the US already charge an exit tax when investors take up fiscal residence somewhere else.

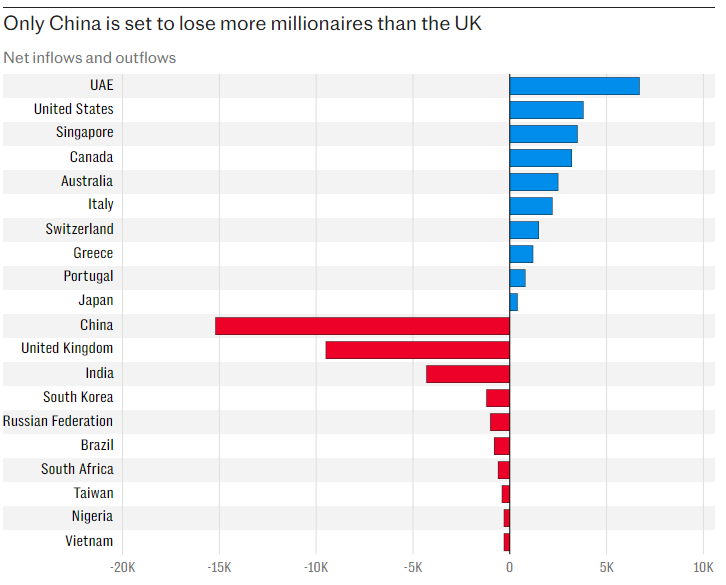

The UK could see a net loss of as many as 9,500 millionaires this year, more than double the 4,200 who left the country in 2023, according to the Henley Private Wealth Migration Report 2024.

Insight firm, Oxford Economics, also found in a survey of 73 non-doms that 63pc were planning on leaving the UK within two years or actively considering leaving shortly.

In Australia and Canada, if you stop being a resident for tax purposes, then you will incur a capital gains tax charge on your shares as though you have sold them.

Meanwhile, the US applies an exit tax to deter high income individuals from renouncing their citizenship.

If an exit tax were introduced in the UK, it could mean an investor leaving the country and sitting on a £200,000 gain would be expected to pay about £40,000 on their way out.

Experts said that the Chancellor could be considering introducing an exit tax in order to prevent a potential exodus of higher earners and business owners. The Chancellor has paved the way for tax rises in her maiden Budget, but ruled out raising income tax, VAT or National Insurance.

Wealth managers have reported a surge in the number of non-doms exiting the UK because of Labour’s crackdown on wealthy foreigners.

They have also seen a number of domiciled individuals relocate elsewhere over concerns Labour will increase inheritance tax or capital gains tax on October 30 to fill a £22bn hole in the public finances.

Nimesh Shah, of accountancy firm Blick Rothenberg, said: “The Government does not want such a capital flight out of the UK.”

He said one option was to water down the current non-dom proposals and the other “more dramatic option” was to introduce an exit tax.

He said: “This works by having a deemed disposal of your assets when you leave, and paying the requisite tax to the authorities. This would be met with massive resistance, and could see legal change, but nothing can be ruled out.”

He added: “The non-dom proposals are a real mess – the Government need wealth and investment, but have a political position which goes against this and you risk reducing tax revenues. Therefore, a severe option like an exit tax may look appealing – and would affect UK domiciled individuals in the same way.”

Arun Advani, a tax expert at the University of Warwick, said an exit tax “would be a lot of work to design, but could be a good idea in principle”.

He said: “The idea behind it is ‘pay your bill when you leave.’ An exit tax is not a trivial step – there’s a lot of legislative change that would be needed. But there’s an argument that if you’re going to do it, you should do it now. Because if you raise capital gains tax, then by the time you introduce an exit tax the horse has already bolted.”

Raising capital gains tax rates in line with income tax rates is one of the fiscal changes the Government could be weighing up.

An HM Treasury spokesman said: “Following the spending audit, the Chancellor has been clear that difficult decisions lie ahead on spending, welfare and tax to fix the foundations of our economy and address the £22bn hole the Government has inherited. Decisions on how to do that will be taken at the Budget in the round.”