Boost for Chancellor as Bank of England slows down government bond sales

Rachel Reeves has been handed a boost of up to £10bn ahead of the Budget after the Bank of England said it was slowing down sales of government bonds amassed during lockdown.

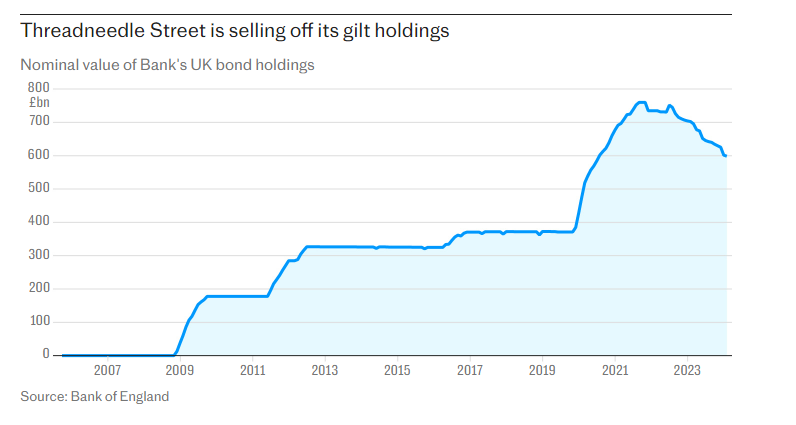

Policymakers voted unanimously to reduce the stockpile of gilts held by the Bank by £100bn over the next 12 months.

While this is the same pace of reduction as this year, only £13bn of these bonds will be actively sold by the Bank, compared with roughly £50bn the previous year.

The effect of this change will be to increase the Chancellor’s headroom by up to £10bn before the Budget, reducing the need for large tax hikes and spending cuts.

It came as the Bank voted to keep rates on hold at 5pc on Thursday, although Threadneedle Street signalled that borrowing costs were likely to be trimmed further in the coming months.

A previous agreement struck by the Treasury means it must make the Bank whole on any losses from its bond-buying spree during Covid and the financial crisis, known as quantitative easing (QE).

The Treasury has already transferred £23.6bn to the Bank this year alone to cover losses on so-called quantitative tightening (QT), which accounts for the sale of gilts.

Threadneedle Street’s decision to reduce the size of its balance sheet by actively selling gilts bought during the pandemic, rather than letting them mature, means taxpayers faced much heavier losses in the short term.

With interest rates at 5pc, the amount the Bank pays to commercial lenders on reserves held at the central bank also far outstrips returns on its stockpile of gilts.

The reverse was true when interest rates were at record lows, which saw £123.8bn in profits transferred to the Treasury between 2009 and 2022.

But fewer active sales in the coming year means the Treasury will be required to transfer less money to the Bank as losses crystallise more slowly, providing a boost for the Chancellor.

Analysts at Goldman Sachs have previously warned that losses on gilts are “weighing heavily on fiscal headroom”.

This is because the Office for Budget Responsibility (OBR), the Government’s tax and spending watchdog, has based its forecasts on the assumption the Bank’s bond sales will be roughly the same as last year.

Back in June, Goldman said “an additional £10bn of fiscal space” could be freed up against the current target to get debt falling in the fifth year “if the OBR extrapolates forward the slower pace of sales”.

Changes to the target itself could also increase Ms Reeves’s headroom to £25bn, based on previous market pricing.

Commenting on its decision, the Bank said a steady reduction in the amount of government bonds it held on its balance sheet – which ballooned to £895bn during the height of the pandemic – would help to provide an extra cushion for future economic shocks.

Policymakers said it would also reduce the risk of a “ratchet upwards” in the size of the Bank’s balance sheet over time, “increas[ing] the headroom and flexibility available to the Bank to use its balance sheet in the future if needed”.

The Bank currently has a stockpile of £659bn in government gilts on its balance sheet.