A growing number of motorists are urging the Government to reconsider a proposed change that would see owners of a certain type of vehicle charged much more.

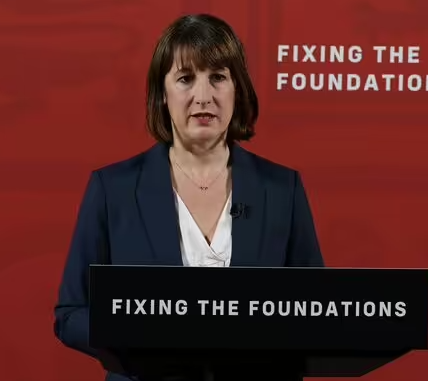

Motorists are urging Chancellor Rachel Reeves to make a u-turn on a controversial tax rise (Image: Getty)

Chancellor Rachel Reeves is coming under pressure to rethink current plans to roll out a massive vehicle tax rise in 2025 that could see drivers charged thousands more for a new car.

The Labour Government’s first budget offered a number of incentives to help motorists, including an extension of the fuel duty freeze.

Nevertheless, one measure that was not stated during the initial announcement is set to drive up a key motoring bill for Brits thinking of buying a certain type of model.

Under the changes made by the Chancellor, motorists who wish to buy a double cab pick-up truck to use as a company vehicle are set to see a sharp tax rise.

From April 2025, the Government will consider these models, which typically have four doors for passengers yet a large open space for luggage, as passenger cars instead of commercial vehicles.

Double cab pickup trucks offer a large carrying capacity and space for five passengers (Image: Getty)

Commonly chosen due to their practicality, all double cab pickup trucks are subject to a fixed benefit in kind (BIK) rate of £3,960 – the same rate that smaller single cab vehicles are also subject to.

However, under the upcoming tax change, employees will now be charged a different rate which is based on their taxable income and the overall emissions output instead.

For example, a £48,000 Ford Ranger that produces over 170g/km of carbon dioxide would be subject to a rate of £17,700 a year, meaning a 20% taxpayer would face a £3,550 yearly fee, whereas those on a 40% rate would be charged £7,110.

Don’t miss…

The easy winter driving mistake that can cause accidents and £1,000 fine [REPORT]

Drivers warned over streetlight speed limit rule that’s never signposted [ANALYSIS]

Drivers risk £5,000 fine for carrying Christmas tree carelessly in car [INSIGHT]

Employees using a double cab pickup as a company vehicle could have to pay thousands more (Image: Getty)

A number of motoring experts against the change have argued that it could impact a wide range of independent businesses, farmers, and construction firms, who are some of the biggest buyers of the vehicles.

Their warning follows a similar controversial decision by the previous Government to significantly increase the tax that private motorists would need to pay on pickup trucks with a maximum payload of over 1,000kg.

Whilst double cab pickup owners were nearly subject to a fivefold rise, a sharp backlash from motorists caused HM Revenue and Customs to axe the change.

Nevertheless, one change made in the budget surrounding the tax applied to company cars was welcomed, with Iain Reid, Head of Editorial at Carwow, supporting the freeze on BIK for electric models.

He continued: “While they’re no longer exempt from vehicle excise duty from April 2025, electric cars will be subject to more favourable first-year tax rates than petrol and diesel-powered cars.

“However rather than incentivising electric car ownership, it looks like she is disincentivising ownership of other types with big increases in VED rates and a big increase in Benefit in Kind for hybrid cars coming in 2028.”