Rachel Reeves’s claim of ‘no tax rises for working people’ in Budget swiftly dismantled _ Hieuuk

Rachel Reeves held Labour’s first budget in 14 years yesterday.

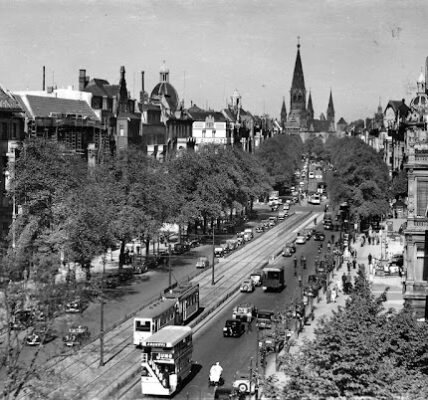

Workers’ pay across the UK could be hit by budget tax rises, economic experts warn (Image: Getty)

Workers’ pay will be hit by Budget tax rises aimed at employers, economic experts have warned.

The increase in employers’ national insurance contributions is a “tax on working people”, the Resolution Foundation’s research director James Smith said.

He added: “This will definitely show up in wages. This is definitely a tax on working people, let’s be very clear about that.

Don’t miss… Fury as Government ‘owes WASPI woman £48,000’ [LATEST]

“Even if it doesn’t show up in pay packets from day one, it will eventually feed through to lower wages.”

Labour had pledged not to heap taxes on working people but the hike in national insurance rates means bosses will pay 15% on contributions, up from 13.8%.

The threshold of £9,100 will also be slashed to £5,000 from April next year, in what was described by Chancellor Rachel Reeves as a “difficult decision”.

Meanwhile economists warned the Government will need to raise up to another £9 billion after next year to avoid cutting spending on unprotected departments.

Although day-to-day spending is set to rise rapidly after Wednesday’s Budget, increasing by 4.3% this year and 2.6% next year, it then slows down to just 1.3% a year from 2026.

That planned slowdown has led some experts to question Ms Reeves’ claim that there will be “no return to austerity”, with others suggesting they mean further tax rises could be announced in later budgets.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said keeping to a 1.3% increase will be “extremely challenging, to put it mildly” and Ms Reeves’ plans “will not survive contact with her Cabinet colleagues”.

He said: “I am willing to bet a substantial sum that day-to-day public service spending will in fact increase considerably more quickly than supposedly planned after next year.

“1.3% a year overall would almost certainly mean real-terms cuts for some departments. It would be odd indeed to increase spending rapidly this year and next, only to start cutting back again in subsequent years.

“I’m afraid, at least on the surface, this looks rather like the same silly game playing we got used to with the last lot – pencil in implausibly low spending increases for the future in order to make the fiscal arithmetic balance.”