Sir Keir has vehemently rejected suggestions that he is “plotting a war on middle Britain”

Sir Keir Starmer has been accused of lying not once but twice over Labour’s tax plans just days before Chancellor Rachel Reeves delivers her Budget next week.

Tory leadership contender Robert Jenrick – who is vying with Kemi Badenoch in the campaign’s final few days – launched his broadside as the PM denied misleading the public during the general election over proposed tax changes.

Labour’s manifesto had pledged not to raise taxes on “working people,” specifically ruling out rises in VAT, National Insurance, and income tax.

However, speculation is rife that those with asset-based income could see increased tax burdens.

Mr Jenrick, speaking to the Henry Jackson Society in London on Friday evening, said: “Sir Keir has lied not once but twice by claiming not to have breached his manifesto promises on tax and by insisting that his Budget will not be an assault on the heartlands of Middle Britain.”

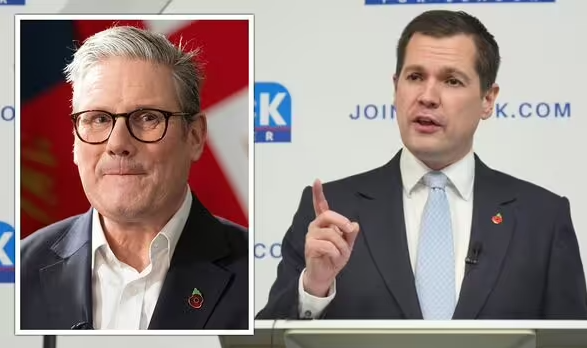

Sir Keir Starmer and Tory leadership contender Robert Jenrick. (Image: GETTY)

“Nobody voted for Rachel Reeves’s raid on working people. This is a political choice and we must fight it.

“It turns out Labour’s election manifesto was another dodgy dossier – they lied to the British people through their teeth.”

Speaking yesterday on the last day of the Commonwealth Heads of Government Meeting (CHOGM) in Samoa, the Prime Minister was asked to define “working people”.

He said it referred to someone who “goes out and earns their living, usually paid through a monthly cheque,” and not someone who can “write a cheque to get out of difficulties.”

Denying he was “plotting a war on middle Britain”, Sir Keir continued: “What we’re doing in the Budget is twofold.

Rachel Reeves delivers her first Budget on Wednesday. (Image: Getty)

“The first part is laying strong foundations, addressing the financial situation we’ve inherited, including a £22 billion deficit. We have to deal with that.

“Previous leaders have sidestepped these issues, creating fictions, but I’m not prepared to do that.”

When asked whether the Labour manifesto had misled the public, as suggested by Mr Jenrick, Sir Keir insisted: “No, we were transparent about the tax increases that would be necessary, regardless of circumstances, as you’ve mentioned. I reiterated this many times during the campaign.

“We were also clear in the manifesto and campaign that we wouldn’t raise taxes on working people, specifying what we meant by that regarding income tax, NICs, and VAT. We intend to honour those promises.”

Kemi Badenoch is vying with Mr Jenrick for the Tory leadership. (Image: Getty)

His remarks came after Sir Keir told Sky News he does not classify those with income from assets such as shares or property as “working people,” suggesting possible tax increases.

He said: “They wouldn’t fall under my definition.”

In a partial retraction on Friday, Downing Street clarified that individuals holding small amounts in stocks and shares still count as “working people.”

Number 10 explained that Sir Keir referred to those primarily earning income from assets in his comments.

Landlords reacted with anger, accusing the Government of “fostering misconceptions” about them.

Ben Beadle, Chief Executive of the National Residential Landlords Association, said: “It is simply untrue to say landlords are not working people.

“Rather than reinforcing misconceptions, the Government should address the core challenge in the rental market – a shortage of homes to rent amid growing demand.”

Ministers have avoided details on next week’s Budget, though sources indicate that it aims to identify £40 billion through tax increases and spending cuts to prevent a return to austerity.

Capital gains tax, inheritance tax, and fuel duty are among the options Chancellor Rachel Reeves could potentially explore to bolster revenues.

She is also expected to raise employer National Insurance by up to two percentage points and lower the earnings threshold for employer contributions, which are forecasted to raise approximately £20 billion.

Ms Reeves has acknowledged that some taxes will need to rise, pointing to a £22 billion gap in public finances, which she attributes to her Conservative predecessors, though she has yet to specify which taxes will be impacted.

In an interview with LBC on Friday evening, the Chancellor said she would avoid raising “the key taxes paid by working people – National Insurance, income tax, and VAT.”

Opposite number Jeremy Hunt argued that raising employer NICs would amount to a “jobs tax” that would “harm businesses” and breach Labour’s manifesto commitment.

The shadow chancellor commented, “Raising employer NICs is effectively a jobs tax that directly impacts working people. It will not only harm businesses but will also result in fewer jobs and lower wages.”

The Budget is scheduled to be delivered on Wednesday.